Digital services

In our 2020 materiality analysis, digitisation is high on the agenda. Internal stakeholders place digitisation fourth, while external stakeholders rank digitisation as the top priority. Digital services also enhance customer satisfaction.

Digitisation has always been a business priority. Projects such as country websites with standardised back-office data, Parking as a Smart Service (PaSS) proprietary platform based on ANPR and the Q-Park Mobile App are specific examples of projects we have realised in recent years.

Digitisation also means making optimal use of technology. We focus on cyber security and secure connections from data collection points to our new energy-efficient data centre.

Business intelligence

We have optimised our business intelligence (BI) for reporting purposes. This now provides data and insights for finance and operations, and helps meet our commercial needs.

Our BI enables us to optimise our control tools and provides better information for making operational and strategic decisions.

Practical application of BI

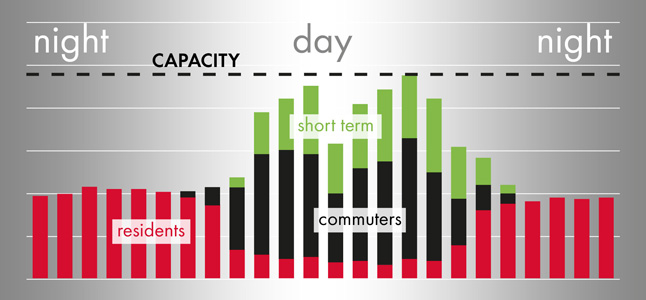

Our BI provides the data we need to calculate the ideal parking capacity (for Real Estate) and parking tariff (for Revenue Management) for a given location so there are always enough spaces available.

Capacity optimisation helps project developers and municipalities to plan more accurately and thus build the right number of parking space at the right locations, for the short and the longer term.

Figure 22 BI used for capacity management

More about our parking capacity calculation.

We also have insights in how our parking facilities are being used during the day. We can use this information to create interesting parking deals, for example, to encourage shoppers to park at off-peak times or at P+R locations.

Interesting parking deals we have tested include:

discounts for those arriving before midday;

weekend parking deals at mobility hubs;

lower parking tariffs for long-stay parking at selected car parks.

On a pragmatic note, we were able to use our BI to meet an immediate need: the coronavirus pandemic presented governments with the ‘keep open or close retail’ dilemma.

Using our BI, we were able to provide a Dutch retail organisation with detailed visitor flows in a multitude of cities.

With our digital commercial tools we were able to make specific propositions to support a more even spread of visitors during the day – safeguarding health and economic issues in urban areas.

PaSS

Contactless parking using our Parking as a Smart Service (PaSS) proprietary platform, uses ANPR to grant customers access. Customers do not need to present their bank card or take a ticket as the parking is paid for in advance or will be paid for via the bank details registered. This saves time and increases parking convenience.

In 2020, we completed implementing PaSS in all our parking facilities in Belgium. This innovation, coupled with national coverage, allows us to create partnerships with Customer Group Partners (CGPs – such as banks) and Parking Payment Service Providers (PPSPs – such as ParkMobile and 4411) who seek to provide additional services for their customers.

They offer a contactless off-street parking solution, with a clear and crisp message to:

effortlessly access and exit Q-Park car parks;

use your preferred payment method.

Figure 22 PaSS

PaSS is also a key element in the contactless parking offering for our own customers:

short-term parkers use the Q-Park Mobile App;

pre-bookers take advantage of online propositions;

long-term parkers have a season ticket.

Results in 2020

168 parking facilities have PaSS installed:

Q-Park Belgium (national coverage) – 42

Q-Park Netherlands – 107

Q-Park UK – 15

Q-Park Denmark – 4

Digital programmes

Cashless and contactless payments

We are constantly optimising our parking management systems and our operational processes. We have offered various cashless and contactless payment options at all our parking facilities since 2016.

Naturally, a motorist can still take a traditional paper ticket and pay by cash or card at a Pay-On-Foot (POF) machine before driving to the exit, but cashless and contactless payments continue to gain popularity.

Progress in digital payment increases safety for our employees, reduces the total investment and cost of ownership of the parking management system and reduces the cost of money management. Some of our car parks are even ‘cashless only’.

Validation

We offer a number of schemes to assist our purpose partners with customers who are 'walk-ins'. We call this validation – it means that our partners can reimburse their customers for all or part of their parking fee.

ICT forward rolling programme

Q-Park ICT works with a forward rolling programme which is filled with projects with defined requirements. This allows for flexibility along the way and enables us to take advantage of opportunities as they arise and to quickly adapt where needed. Part of the rolling programme:

CRM;

digitise the validation system and value cards;

focus on mobile first solutions.

Our digital services also contribute to SDG 9.