Materiality analysis

New analysis in 2020

Every two years we conduct a materiality analysis, periodically identifying the topics that are most relevant to our stakeholders. We performed the previous materiality analysis in 2016 and updated this with international desk research in 2018. This year we conducted a new analysis, determining material topics which reflect Q-Park's economic, environmental and social impacts as well influence decisions of our stakeholders.

Design of the study

In line with GRI and IIRC guidance, extensive desk research was carried out to draw up a shortlist of topics. This research included:

Figure 9 Materiality analysis - method

A total of 20 topics were shortlisted and defined at the same level of abstraction, forming the material topics on which Q-Park can steer. The shortlist was presented to a range of internal stakeholders (respondents) in a random sequence (see table). They were asked to select the 5 topics they consider to have the most (potential) impact and the 5 topics they consider to have the least (potential) impact on Q-Park’s operations.

The score for external stakeholders was derived by combining the results of the previous materiality analyses conducted in 2016 and 2018, and incorporating the aforementioned 2020 desk research which included trends, and peer and sector analysis.

Results

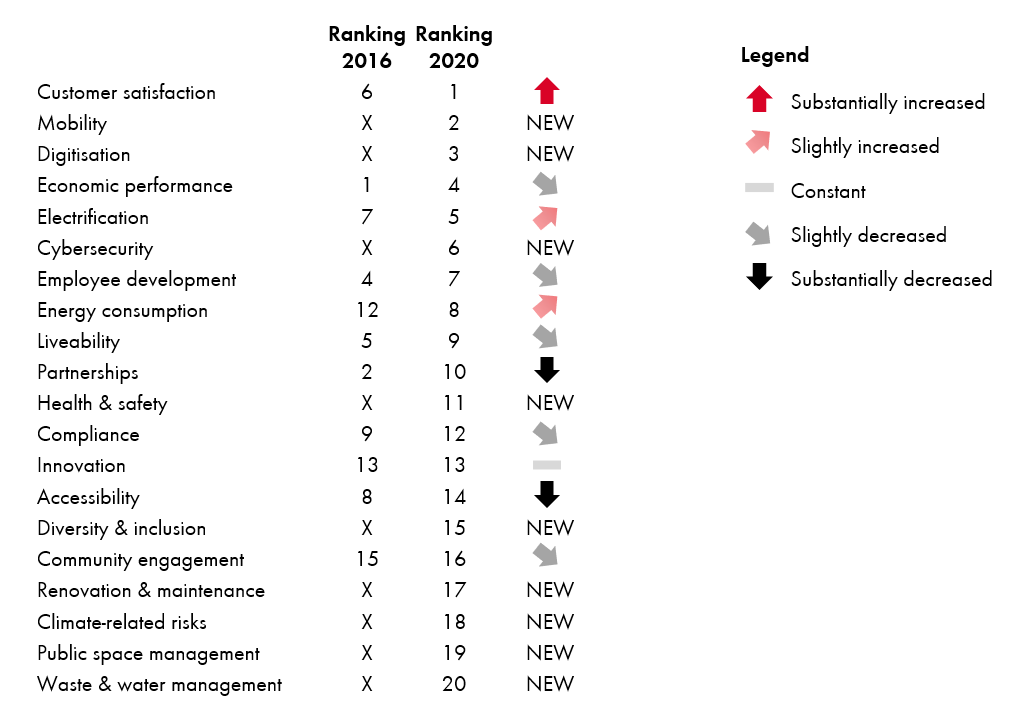

The ranking figure shows how the topic ranking in 2020 has changed compared to 2016. Note also that the 2016 materiality analysis contained five fewer topics than in 2020.

Topics indicated with an X in the 2016 analysis were either not included in the previous analysis or the definition has changed significantly so the materiality cannot be compared. Topics that have dropped down the ranking are still important to the business. They may now be considered as part of our everyday activities, expected to be taken care of by all players in our industry and/or are less relevant due to external changes.

Table 1 Materiality analysis - 20 shortlisted topics

Topic | Definition | |

|---|---|---|

1 | Digitisation | Increasing our focus on ICT, data analytics and APIs to prepare ourselves for further efficiencies, effectiveness, customer satisfaction and partnerships. |

2 | Compliance | Ensuring we are compliant with new and existing laws and regulations for business continuity and long-term value. |

3 | Health & Safety | Managing a safe and healthy environment for our employees as well as customers, thereby preventing incidents, emergencies and accidents. |

4 | Diversity & Inclusion | Creating a diverse and inclusive organisation by creating equal opportunities for all and ensuring general well-being in the workplace. |

5 | Partnerships | Working together with a variety of partners to facilitate inter-connectivity between people, cars and other modes of transportation. |

6 | Innovation | Innovative solutions in all business aspects other than digital, to improve health and safety, liveability, mobility and sustainability impacts. |

7 | Employee development | Developing the skills and competencies of our employees to secure a well-trained, dedicated, and satisfied workforce. |

8 | Energy consumption | Reducing energy use by increasing our energy efficiency and use of renewable energy sources. |

9 | Electrification | Expanding our e-car fleet and e-charging stations in line with market developments in order to meet increased demand. |

10 | Accessibility | Improving accessibility of vital functions while enhancing quality of life. |

11 | Liveability | Contributing to environmentally friendly, economically viable and more open, green and sustainable cities made for people (not cars). |

12 | Mobility | Enabling people to be mobile (i.e. for work, school, family & friends) by connecting travel by car with public transportation, walking and cycling. |

13 | Cyber security | Managing the continuity of our ICT systems and ensuring the security of crucial information and sensitive customer data. |

14 | Economic performance | Promoting ethical business practices along our value chain and collaboration with all our partners to ensure long-term profitability. |

15 | Community engagement | Managing relevant community concerns while enabling people to use our parking facilities without limiting the use of public space for other people. |

16 | Customer satisfaction | Leveraging customer insights in order to refine our propositions, thereby improving customer satisfaction. |

17 | Climate-related risks | Creating solutions to mitigate financial risk of climate-related issues. |

18 | Waste & Water | Reducing water consumption and waste disposal. |

19 | Renovation & maintenance | Renovating, as well as maintaining and cleaning assets with the least amount of negative impact on the environment for the short and longer term. |

20 | Public space management | Using private investment funds to establish solutions for the public space, allowing public funds to be freed for social, health and educational purposes. |

Figure 10 Materiality analysis - ranking

2020 Materiality matrix

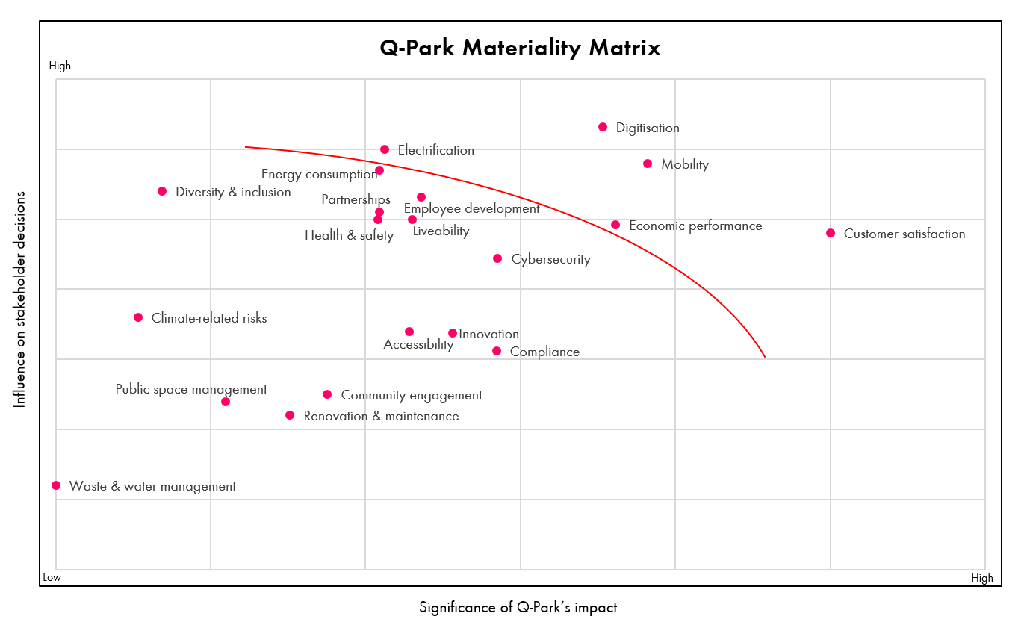

For each of the material topics, the Q-Park Materiality Matrix shows the influence on stakeholder decisions against the significance of Q-Park’s impact in those areas.

The five most important topics are at the top, above the red line. We have mapped the materiality topics against our Q-Park Liveability Model and have added icons throughout the report indicating the relevance of the top five to ten topics in our CSR reporting.

Figure 11 Top 5 materiality topics

Figure 12 Q-Park Materiality Matrix

For external stakeholders, electrification, particularly the number of EV charging points in parking facilities, should get strategic attention.

Result highlights

Customer satisfaction is the most impactful topic for internal stakeholders, digitisation is the most relevant topic for external stakeholders.

Economic performance is a top 3 topic for internal stakeholders, while external stakeholders place this topic in 10th place. In 2016, economic performance ranked number 1.

Electrification is a top 3 topic for external stakeholders, internal stakeholders rank this topic in 11th place.

Partnerships was ranked in 2nd place in 2016. In 2020, this topic has dropped back to place 10.

Waste & water management is for both internal and external stakeholders the least impactful and least relevant topic. This is merely a control topic ensuring a relevant shortlist.

Climate-related risks has a low score for almost all internal stakeholders. Only those in Germany consider this topic slightly important.

By placing an emphasis on materiality, we provide disclosures and indicators that reflect our economic, environmental and social impacts, based on this materiality analysis. To make it easier for stakeholders to navigate this report, we have mapped our material topics with the Q-Park Liveability Model.